Benefits Checking

Enjoy the Perks. Spend Smarter.

Discover the perks of Benefits Checking. This account makes it simple to manage your money and take advantage of useful financial tools, and smart discounts on financial services and everyday purchases.

Next Level Checking

Take your account to the Next Level with Benefits Checking and Benefits Plus Checking.

Identity Theft Protection with Benefits Checking and Benefits Plus Checking

Cell Phone Coverage with Benefits Checking and Benefits Plus Checking

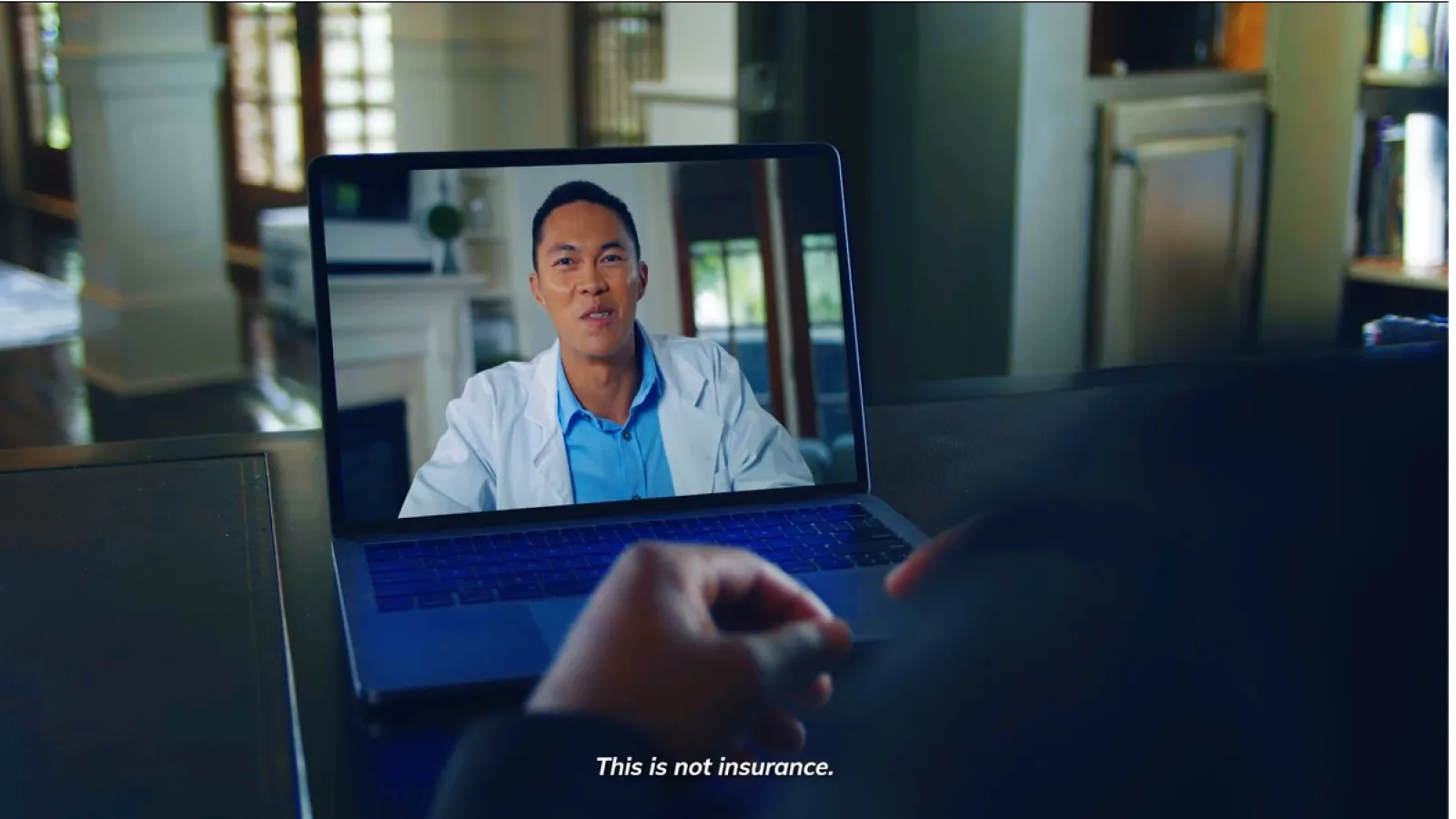

Telehealth with Benefits Checking and Benefits Plus Checking

Enjoy the Perks of Benefits Checking

Get the account that meets your needs with unlimited digital banking, a free debit card, generous member benefits and more.

- Identity theft monitoring and resolution services1

- Credit report and credit score access2,3

- Travel and leisure discounts*

- Roadside assistance service4

- Cell phone protection4

- Free Debit Card

- Free Online & Mobile Banking with Bill Pay

- Free E-statements

- Buyers protection and extended warranty4

- Telehealth5

Benefits Checking Fee Schedule

Minimum Opening Deposit

Monthly Service Fee

Minimum Balance to Avoid Service Fee

Minimum Opening Deposit

$25

Monthly Service Fee

$4.95

Minimum Balance to Avoid Service Fee

$2,500 average daily balance

* Registration/activation

required

1Benefits are available to personal checking

account owner(s) and their joint account owners subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication,

registration and/or activation. Benefits are not available to a "signer" on the

account who is not an account owner or to businesses, clubs, trusts,

organizations and/or churches and their members, or schools and their

employees/students.

2You will have access to your credit report and score provided your

information has been verified by the CRA. Credit Score is a VantageScore 3.0

based on Equifax data. Third parties may use a different VantageScore or a

different type of credit score to assess your creditworthiness.

3Credit Score Tracker:

Once credit file monitoring has been activated and you have requested your

first credit score, you may request a new credit score each month to be plotted

on your Credit Score Tracker graph. Monthly email notifications will be sent to

let you know when your new score is available.

4Special Program Notes: The descriptions herein are summaries only

and do not include all terms, conditions and exclusions of the Benefits described.

Please refer to the actual Guide to Benefit and/or insurance documents for

complete details of coverage and exclusions. Coverage is provided through the

company named in the Guide to Benefit or on the insurance document. Guide to

Benefit and insurance document can be found online. Insurance Products are

not insured by the NCUA or any Federal Government Agency; not a deposit of or

guaranteed by the credit union or any credit union affiliate.

5Available

for the account holder and their spouse/domestic partner and up to six (6)

dependent children age 2 and older. This is not insurance.