E-Services

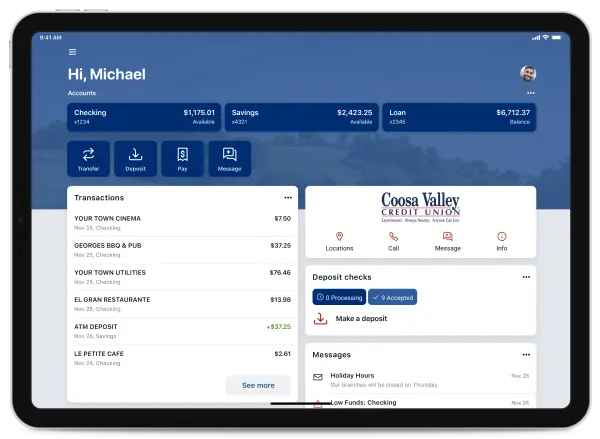

Wherever You Go, Online Banking Goes With You.

Enjoy a personal connection to your Coosa Valley Credit Union account anywhere — anytime.

Frequently Asked Questions:

Online Banking.

What is Online Banking?

Online Banking is the most convenient way to manage your money. No matter what device you use, you get a smooth, personalized banking experience. That means you have complete control of your Coosa Valley Credit Union account on your smartphone, tablet and computer.

Why should I use Online Banking?

It lets you manage your Coosa Valley Credit Union account from anywhere you want — it's your personal banking portal. Whether you log in to your account online or through the mobile banking app, you have access to the same powerful features all in one place.

Here's a look at what you can do with Online Banking:

- View balances: Quickly check your account from anywhere

- Manage transactions: Search your recent activity, filter by tags, even add an image or note to an entry

- Transfer funds: Initiate one-time, future date or repeating transfers

- Make payments: Make person-to-person or bill payments from any device

- Deposit checks: Snap a photo of any check you need to deposit

- Get alerts: Receive push notifications and alerts to stay in the know

- Ask for help: Have a digital conversation with support staff if you have any questions about your account

How do I use a Conversations feature?

If you see a transaction that doesn't seem right, click on the "Ask Us About This Transaction" button. Type in your question and Conversations will connect you directly with our support staff. They can see exactly which transaction you're asking about, so you get your answers fast. That way, you can put your mind at ease — without a phone call or trip to the credit union.

How secure is Online Banking?

Online Banking is extremely secure. Your account information is password-protected and highly encrypted.

How do I enroll in Online Banking?

If you have not previously used online banking, then you will have to go through the enrollment process:

- Request a mobile banking profile via the login screen on desktop

- Provide identifiable information that matches what is on your account to confirm your identity

- Create a username and password to use each time you sign on, whether via online or mobile

Note: If you cannot provide the correct identifiable information which matches that on your account after 5 tries, you will be locked out of the Online Banking system for 24 hours.

How will I get notified of updates regarding my account?

When completing the registration process, agree to push notifications in order to stay up-to-date on account changes, messaging replies, and more.

Frequently Asked Questions:

Logging In

How do I access Online Banking?

You can access the new Online Banking and your account on a desktop, laptop, mobile phone, or other internet-accessible device. Simply log in with your existing online banking credentials to both online and mobile banking. There are two access points:

- Visit our website and click Log In to get started

- Download the NEW mobile banking app from the Google Play or Apple Store

What is 2-Factor Authentication and why is it used?

Two-Factor Authentication is a security measure that allows you to request a one-time access code to log in to Online Banking. The code enhances the security by creating an added layer on top of your unique username and password. This security process helps to verify you and better protect your credentials and the accounts you can access.

When I log into Online Banking, do I need to get a confirmation code every time I log in?

No. Check the "Don't ask for codes again on this computer" box if you do not want to receive a confirmation code or phone call each time you log in. If you prefer to input a confirmation code with each use, you can leave the box unchecked or use the 2-Factor Authentication app to deliver the code.

Note: If you ever want to remove a device and reset your security settings, you can change them in settings once logged in to Online Banking.

How can I log in to Online Banking if I can't get a verification code through text message?

Two-Factor authentication uses a unique one-time access code to verify identity and log on to Online Banking. If you are unable to receive text (SMS) messages, you can choose to receive your access code via a phone call:

- On the verification code screen click Try another way located beneath the Verify button

- Select Phone Call and click Next

- You will receive an automated phone call that will provide your access code (Have a pen and paper ready)

- Return to the verification code screen

- Enter your access code and click Verify

Note: If you are still having trouble, contact the credit union to ensure we have the correct phone number on file.

How do I reset my 2-Factor Authentication?

If you would like to reset your 2-Factor Authentication, do the following:

- Once logged in to the Online Banking app, select the "hamburger bars" in the upper left corner of the screen

- Select your name at the bottom of the menu, then select "Settings"

- Under Settings, select "Security"

- Select "Reset 2-Factor Authentication"

- When prompted to confirm this action, select "Reset"

- Follow the prompts to complete setup

I can't remember my username name or password

You can recover your account yourself by going through "Forgot Password?".

Frequently Asked Questions:

Transfers & Transactions

How do I make a transfer between my accounts in Online Banking?

To transfer between your credit union accounts in Online Banking:

- Log In

- Click Move Money > Transfers > Make a Transfer online or tap the slideout menu > Transfer

To make a transfer in the mobile app:

- Select your To and From account and amount

- Click More Options to change the frequency and date if desired

- Click Submit

Where can I view pending transactions on my account?

- Log in

- Select the account you are needing to view

- To view all account activity, view the Activity tile or Transactions in the mobile app

All of my transactions are showing in one place together. Why?

On the homepage of Online Banking, you see a conglomerate view of all of your accounts. Every transaction you make with each account will show in this combined feed. To see transactions for each account individually, select the account you are needing to view, then select transactions.

How do I download transactions in Online Banking?

Account transactions can only be downloaded through Online Banking desktop.

- Log In

- Click Accounts

- In the Accounts section, select the account you like to download transactions for

- In the Activity area, select the "Download" icon next to the print and search icon

- On the Download Activity window, select the Date range and File Type and click Download

How do I print transactions in Online Banking?

Account transactions can only be printed in Online Banking desktop.

- Log In

- Click the Accounts tab

- In the Accounts sections, select the specific account

- On the Activity section, select the "Printer" icon. Online transactions that show in the Activity section will print

- A print screen appears with a print preview and print configuration options

- Using the dialog, configure the print settings, then select "Print"

Where can I view my loan account information?

Our Online Banking now allows members to see their loan balance and information right from within the app or from online. This information will appear alongside any checking or savings accounts and can be accessed by selecting the loan account, the same process as a checking or savings account.

How do I view my eStatements?

If you have setup your account to access eStatements:

- Select or click on the account on the main dashboard you'd like to manage

- Under the account name, you will find a list of options - among them being "eStatements"

Frequently Asked Question:

Bill Pay

What is Bill Pay?

Bill Pay allows you to pay anyone, anywhere right from your computer or mobile phone. There is no limit to the number of bills you can pay, and this service is free to all members with a checking account.

How do I pay a bill in Online Banking?

- Log in

- Select Move Money > Payments or Tap Pay under your account in mobile

- If it is your first-time using Payments, it will ask you to enroll, click Enroll

- Select Pay a bill or Pay a person (online only)

- Select the merchant or person you would like to pay

- Select an account to take funds from, and then input the Amount

- If you would like to set the date for the payment, Select More options and select the desired date

- Select Submit

Frequently Asked Questions:

Messages

What is the new conversation feature?

We're making it easier than ever for members to get in contact with our member service team. Don't have time to call us or stop by a branch? Send a message via app or desktop and a member service consultant will respond shortly.

How do I send a message in Online Banking?

Whatever device you are on, it's easy for you to start a secure conversation with the credit union:

- Log in to Online Banking via the Login button on the website or via the mobile app.

- From a desktop, click on the envelope icon in the upper right-hand corner of Online Banking or select Conversation from the dashboard of mobile banking.

- Click Start a conversation or click the conversation icon on mobile.

- Type your message and click Send.

Frequently Asked Questions:

Remote Deposit

How do I make a mobile deposit in Online Banking?

Mobile deposit is available for all checking accounts, but you must enroll first.

- Log in

- Select Deposit under your checking account OR select Deposit Check from the slideout menu in the mobile app

- Click Enroll Account and go through the sign-up steps, if necessary

- Once your request has been processed and approved, tap Deposit a Check

- Enter the check amount

- Tap Continue

- Select the account to deposit to

- Take a picture of the front of the check and tap continue

- Take a picture of the back of the check and tap continue

- Verify the information and tap Submit

Note: Mobile deposit can only be done through the mobile app.

Frequently Asked Questions:

Update Info

How can I change my phone number, email address, or primary address in Online Banking?

You can update your phone number, email address, or primary address in Online Banking.

- Log In

- Click on the User Profile icon and click Settings

- Click Edit next to your phone, email, or address

- Verify your password

- Edit your contact information

- Click Save

Note: Phone and email updates will happen immediately. All address updates will be reviewed by a member service representative and you may be contacted for additional information.

How do I change my username or password in Online Banking?

To change username:

- Log in

- Select your username icon in the top right corner or menu in mobile banking

- Select Settings and then select Security option on the left side menu

- In the Username field select Edit

- Enter your current password when prompted

- Change your username and select Save

To change password:

- Log in

- Select your username icon in the top right corner or menu in mobile banking

- Select Settings and then select Security option on the left side menu

- In the Password field select Edit

- Enter your existing password, and then enter a new password

- Select Save

How do I reorder checks?

Similar to the process for viewing account eStatements:

- Select or click on the account on the main dashboard you'd like to order checks fior

- Under the account name, you will find a list of options - among them being "Reorder Checks"

How do I manage my Alert Preferences?

Similar to the process for reordering checks:

- Select or click on the account on the main dashboard you'd like to manage alerts for

- Under the account name, you will find a list of options - among them being "Alert Preferences"

- Follow prompts

Frequently Asked Questions:

Miscellaneous

Which Internet browsers and mobile operating systems are compatible with online banking, mobile banking and digital wallet?

Mobile Operating Systems

iOS

Currently supported: Effective on November 18, 2024, our Digital Banking Platform is supported on Banno Mobile version 3.18 or newer on devices running iOS version 17.0 or newer.

Android

Effective on March 19, 2024, our Digital Banking Platform is supported on Banno Mobile version 3.7 or newer on devices running Android version 8.0 or newer.

Browsers

Microsoft Edge

Microsoft Edge will be supported at the latest version only. The Banno Digital Platform may deny access to older Microsoft Edge versions 60 days after a new version is released. The legacy version of Microsoft Edge now has an official end-of-life date from Microsoft.

Google Chrome

Chrome should automatically update and major updates are released approximately every 12 weeks. If Chrome is two versions older than the current stable channel version, the Banno Digital Platform may deny it access.

Apple Safari

Each year Apple typically makes upgrades to Safari during the fall. Approximately 60 days after a new version is released, the Banno Digital Platform may deny older versions access. However this change requires that the new Safari version is available on both MacOS and iOS devices.

Mozilla Firefox

FireFox should automatically update. If FireFox is two versions older than the current stable channel version, the Banno Digital Platform may deny it access.

How do I set up Touch ID for iOS?

- Tap the slideout menu and select Settings.

- Tap Security in the menu.

- Tap the toggle next to Touch ID.

- Select Enable Touch ID.

Why am I getting a Date & Time Error?

If you get an error when logging in on the app that states you need to set your date and time to auto update, do the following:

- Go to your phone's settings and find Date and Time

- Once you select that category within your settings, make sure that it is set to "Auto Update" - and that will fix that error